|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Refinance Rates for a 680 Credit Score: Pros and ConsIntroduction to Refinance RatesRefinancing a home loan can be a strategic financial move, particularly for those with a credit score of 680. This score is considered fair to good and can significantly influence the refinance rates you might receive. Here, we explore the nuances of refinancing with this credit score. Factors Affecting Refinance RatesCredit Score ImpactA credit score of 680 can position you in a favorable spot, though not at the prime level. Lenders view this as a moderate risk, which typically translates to competitive, but not the lowest, interest rates. Market ConditionsThe overall economic environment plays a crucial role. Rates fluctuate based on market trends, making timing an essential aspect of refinancing. Advantages of Refinancing with a 680 Credit Score

Challenges to Consider

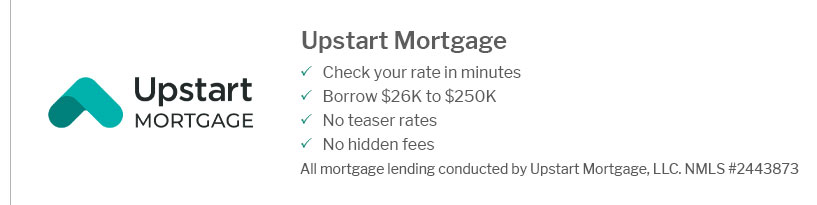

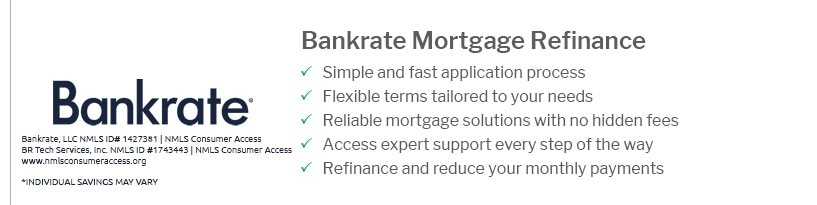

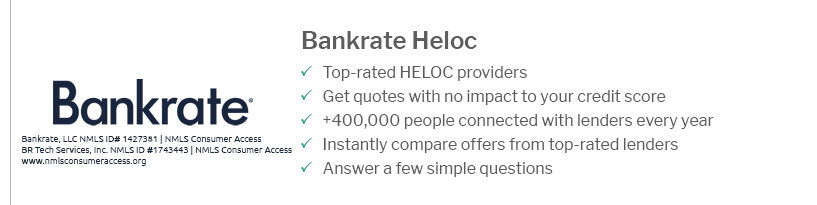

Finding the Best Refinance OptionsChoosing the best company to refinance house is crucial. Comparing multiple lenders can yield better rates and terms, tailored to your financial situation. Frequently Asked QuestionsWhat is the average refinance rate for a 680 credit score?While rates vary, borrowers with a 680 credit score often see rates slightly higher than prime offerings, generally ranging from 4% to 5% depending on other financial factors and market conditions. Can improving my credit score lower my refinance rate?Yes, enhancing your credit score can qualify you for lower interest rates, potentially saving you thousands over the life of your loan. Is a 680 credit score the best credit score to refinance home?While a 680 score is solid for refinancing, higher scores can unlock even better rates. It's beneficial to aim for a score above 700 for more competitive offers. https://www.myfico.com/credit-education/calculators/loan-savings-calculator/

A Higher FICO Score Saves You Money ; 760-850, 7.167 % ; 700-759, 7.403 % ; 680-699, 7.518 % ; 660-679, 7.589 % ; 640-659, 7.72 %. https://www.investopedia.com/today-s-refinance-rates-by-state-dec-4-2024-8755087

At a current average of 6.84%, 30-year refi rates are down more than a quarter percentage point vs. two weeks ago. But they still sit 83 basis ... https://www.apexmortgagebrokers.com/conventional-loan-details/10-down-rates-freddie-mac-conforming-loans/680-fico-score-interest-rates-for-conforming-10-percent-down-loans

Discover competitive interest rates with 680 to 699 FICO scores at Apex Mortgage Brokers. Only 10% down payment required!

|

|---|